Dear readers, the Network Law Review is delighted to present you with this month’s guest article by Richard N. Langlois, Professor of Economics at the University of Connecticut.

* This paper emerged from a keynote talk at the Third Annual Mercatus Center Antitrust Forum on

January 18, 2024, at George Mason University, in Arlington, Virginia. It was first published as a Mercatus Center Working Paper, available at http://dx.doi.org/10.2139/ssrn.4898032.

***

Abstract

A meme is a useful cognitive device: it compresses complex information into a simple structure for easy transmission from person to person. But compression implies a loss of detail and nuance. To put it another way, memes can be a substitute for careful inquiry. And, of course, even as they glide fluidly from mind to mind, memes can be flat-out wrong. In the field of antitrust, the most significant and most frequently encountered memes give credit to antitrust oversight—what the New Deal antitrust czar Thurman Arnold famously called “the policeman at the elbow”—for ensuring that large firms did not stand in the way of innovation. Careful historical inquiry suggests, by contrast, that most of these memes far overstate the positive value of antitrust scrutiny and far understate the importance of dynamic competition as the spur to innovation. History also suggests that even if antitrust scrutiny can be a good cop, it can also be a bad cop. In many cases, antitrust scrutiny has helped slow the rate of innovative activity and alter its direction in ways that were often the opposite of what was intended.

1. Industrial Policy

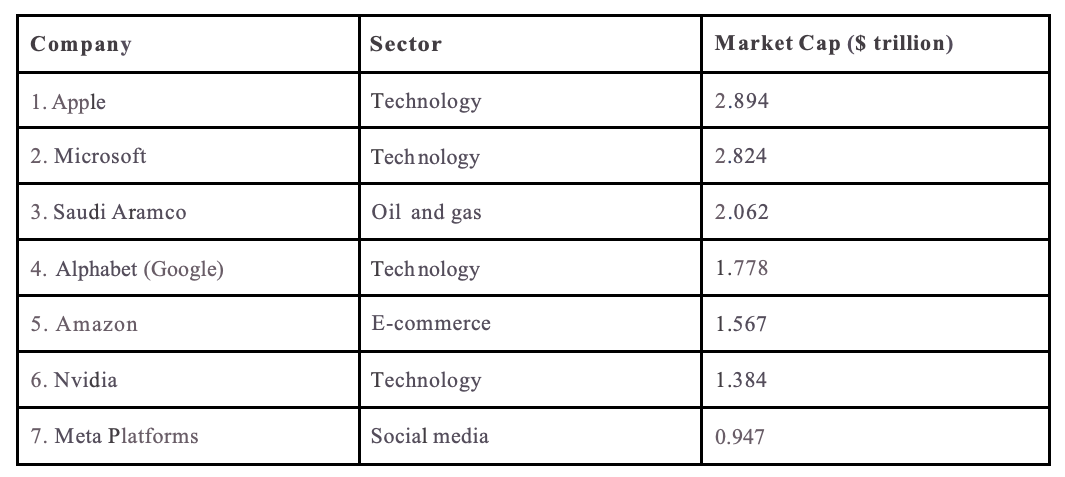

With the exception of the Saudi Arabian oil company, the most valuable businesses in the world today are American high-tech companies. (See table 1.) To observers outside the United States, this is evidence of glorious success. Other countries long for—and often futilely subsidize—such “national champions.” By contrast, the United States has long pursued what Tim Wu, President Joe Biden’s former special assistant for technology and competition policy, rightly calls “a distinctively American form of industrial policy” (Wu 2023). Rather than encouraging its national champions, the United States has pursued a policy of undermining its national champions. This distinctive industrial policy has a long history. After World War II, for example, when IBM dominated the worldwide mainframe computer industry, both Congress and the Department of Justice pursued an active anti-IBM policy (Bresnahan and Malerba 1999, 90–91). Other once-successful industries, including automobiles and consumer electronics, were also recipients of American-style industrial policy. The justification behind this odd industrial policy is, of course, antitrust. For many, all these national champions must necessarily have achieved their startling success not by what Judge Learned Hand famously described as “superior skill, foresight and industry” but by anticompetitive behavior.[1]

Table 1. Top Corporations by Market Capitalization, 2024

In one conceptualization, antitrust is supposed to function as a “policeman” constantly watching over industry to identify and punish anticompetitive behavior. Thurman Arnold, the activist head of the Antitrust Division of the Justice Department during the Franklin D. Roosevelt administration, wrote in 1940 that the “maintenance of a free market is as much a matter of constant policing as the free flow of traffic on a busy intersection. It does not stay orderly by trusting to the good intentions of the drivers or by preaching to them. It is a simple problem of policing, but a continuous one”[2](Arnold 1940, 122). This perspective stands in contrast to the view, nowadays most closely associated with Joseph Schumpeter (1950), that sees competition not as the “maintenance of a free market” but as a dynamic process of change and innovation. In the Schumpeterian view, it is competition itself that is the best policeman, and what appear to be “anticompetitive practices” are mostly inevitable, but in the end futile, attempts to protect players from the gale of creative destruction.[3]

For Wu as for Arnold, however, this dynamic process of competition cannot be trusted. Left to its own devices, the market will necessarily generate what Arnold famously called “bottlenecks of business” that impede the competitive process (Arnold 1940). It is for this reason that we need a “policeman at the elbow” to ensure that anticompetitive practices do not block what would otherwise be a quasi-Schumpeterian process (Wu 2020). As evidence, Wu points to some of the major antitrust cases of the post–World War II era. Were it not for antitrust prosecution (or its threat), he argues, large corporations would have monopolized new technologies, slowing innovation and new entry. In making this case, Wu effectively endorses a number of popular memes about the effects of well-known antitrust cases.

The problem with this argument is that it does not withstand careful historical scrutiny. In reality, it was mostly the pressure of Schumpeterian competition, not these famous episodes of antitrust, that opened up new technological frontiers and introduced new organizational forms. Upon close examination, the popular memes of antitrust are actually myths of antitrust.

AT&T

One such myth involves the transistor, arguably the most important innovation of the 20th century. The conventional account goes this way: Because of a suit that the Department of Justice brought a few months before the breakthrough, AT&T was forced to license the new technology widely, denying AT&T monopoly rents from its patent and calling forth an efflorescence of new entrants to commercialize the technology. Closer examination reveals, however, that, in reality, antitrust contributed little to the course of this history.

If AT&T were engaged in anticompetitive behavior, it was the result of regulation, which the company had long been employing as a fountain of rent. AT&T’s local operating companies were regulated at the state level, and its interstate operations, AT&T Long Lines, were regulated by the Federal Communications Commission (FCC). In addition, however, AT&T owned two unregulated divisions, Bell Labs and Western Electric, its captive suppliers of telephone equipment. This arrangement allowed AT&T to mark up the equipment Western Electric sold to the regulated units (Peters 1985; Temin and Galambos 1987), thereby engaging in a form of regulatory arbitrage called tunneling. When state-level regulatory agencies began complaining about the rate hikes that AT&T’s local operating companies were demanding during the period of rampant inflation after World War II, the Justice Department saw the chance to force the divestiture of Western Electric.[4] The suit also insisted that AT&T license its patents to all comers at reasonable rates.

To forestall the breakup, AT&T entered into negotiations with the Justice Department and the FCC. By allocating more of the joint fixed costs of production to Long Lines, the Bell System could lower its charges to the customers of the local operating units, an inefficient cross-subsidy that would eventually come back to haunt the company. In January 1956, AT&T and the Justice Department signed a consent decree that made no mention of divesting Western Electric. Instead, it required AT&T to stay out of businesses unconnected to telephony, something the firm had already decided to do. It also required AT&T to license some 8,600 existing patents for free and to license all future patents at “reasonable and non-discriminatory rates” (Lewis 1956).

The agreement actually did nothing more than formalize what was already AT&T policy (Peters 1985, 265). Unlike the research labs of other large, vertically integrated American firms of the era, Bell Labs had little incentive to maximize patent revenues, as it was funded not out of royalties but rather by a fee rolled into the rate bases of the regulated operating companies (Grindley and Teece 1997, 12). Much more importantly, AT&T understood that, as a giant buyer of electrical technology of all sorts, it would benefit from allowing its multifold existing suppliers and potential future suppliers to build on Bell’s research. This was especially clear in the case of a general-purpose technology like the transistor. An AT&T vice president put it this way: “We realized that if this thing [the transistor] was as big as we thought, we couldn’t keep it to ourselves and we couldn’t make all the technical contributions. It was to our interest to spread it around. If you cast your bread on the water, sometimes it comes back angel food cake.”[5] Indeed, Bell Labs worked hard to diffuse the technology long before the consent decree was signed, holding major symposia, including one in 1952 for which 35 firms paid $25,000 each to attend (Nagler, Schnitzer, and Watzinger 2021; Tilton 1971, 75).

In 1983, the Justice Department would try once again—this time successfully—to break up AT&T.[6] This result, which opened up American telecommunications, has often been counted as a victory for the antitrust policeman. But it was, in the end, far more an act of deregulation than one of antitrust. Indeed, as the lead attorney for AT&T put it, “antitrust and regulation are, for us, two sides of the same coin” (Temin and Galambos 1987, 116). Partly as a result of the inefficient cross-subsidy, though mostly as the result of the opportunities for value creation being generated by new technologies like microwave transmission and computer networking, the unified Bell System and its regulators at the FCC were under attack from upstarts like MCI and Sprint. Antitrust was but one front in that battle. At the same time, AT&T had come to chafe at the constraints of the 1956 decree, which made it cumbersome or impossible for the company to enter such areas as enhanced network services and data processing that were complementary to its telecommunications capabilities (Peters 1985, 266–67).

Thus, although AT&T recognized that some sort of deregulatory breakup was inevitable and perhaps even desirable, the company wanted to structure the deal its way: to abolish the 1956 consent decree and to retain Western Electric, even if that meant giving up other things. William Baxter, the head of the Antitrust Division of the Justice Department, agreed. The only parts of the company that possessed the character of natural monopoly, he believed, were the local operating companies, which could continue to be regulated at the local level; these units could be cleanly shorn off, permitting AT&T to become—as the company itself desired—an independent electronics firm that, freed from the constraints of the 1956 consent decree, could compete in the technologies of the future, including in computers against IBM[7] (Temin and Galambos 1987, 282).

IBM

IBM had also long been the beneficiary of America’s distinctive industrial policy. As early as 1936, the Supreme Court decreed that IBM was engaged in an illegal tying arrangement.[8] Like suppliers of expensive capital equipment since the first industrial revolution, IBM leased its machines rather than selling them, thus encouraging downstream entry by turning a daunting up-front investment into a flow of services. In addition, in the days of punched-card equipment, IBM insisted its customers purchase their cards only from IBM itself. Like many before and since, the Supreme Court considered tying arrangements an effort to “leverage” a company’s market power in one product into an additional monopoly in another area—in this case, to leverage advantage in information-processing equipment into a monopoly over punched cards.[9] A consent decree demanded the creation of an independent market in cards.

During and after World War II, IBM continued to prosper, and the issues of leasing and bundling surfaced again. The Justice Department once more filed suit against the company in 1952.[10] As in the simultaneous litigation against United Shoe Machinery, the government was demanding, among other things, an end to the long-standing lease-only policy.[11] The resulting consent decree, signed in early 1956 before any legal proceedings could begin, acceded to essentially all government demands (Fisher, McKie, and Mancke 1983, 34–35; Sobel 1983, 135–40). The provision that seemed most significant at the time was that IBM agreed to sell enough rotary presses to competitors that the company would be manufacturing less than 50 percent of all punched cards within seven years. In parallel with United Shoe, IBM agreed to cease long-term leases and to sell computers on terms comparable to their leases. (Because customers understandably preferred leases to purchase, this provision would eventually lead to the rise of third-party leasing firms that bought IBM machines and then leased them to others.) In addition, the agreement required IBM to license at reasonable rates all its current and future patents.

To Thomas Watson Jr., who became the chief executive officer of IBM on the death of his father in that same year, the decree looked like victory not capitulation. Although IBM was still earning considerable profit from its punched-card business, Watson believed that tabulating machines were the wave of the past. The future would be digital computers and electronics, and the consent decree liberated the company to pursue that future.[12] Although the decree required IBM to license all of its inventions, the company could avoid sharing technology if it pursued a policy of vertical integration and simply did not sell the fruits of its innovation on the market (Usselman 2009, 269). This is a theme to which I will return: often antitrust interventions that were intended to encourage small market players actually have had the unintended consequence of fostering vertical integration.

As the age of digital computers dawned, IBM continued its leasing and bundling practices. The company’s business model had always been one of tailoring services to the needs of customers rather than selling machinery (Usselman 1993). This policy was a driver of innovation: because customers would not face the sunk costs of legacy machines (which the company routinely resold outside the United States), IBM had full scope and incentive to constantly proffer new and better technology, including electronics. Bundling made sense in an era in which memory and processing power were limited, and there were considerable interdependencies between software and hardware. To Watson’s great frustration, IBM would soon learn, however, that, unlike hardware, software offered no economies of scale in production, and the company began to experience an in-house version of Baumol’s disease (Baumol and Bowen 1965). As hardware became cheaper, labor-intensive programming ate up increasingly large shares of budgets and personnel (Usselman 2004, 107). IBM’s response was to develop, at great cost and risk, the System/360 series, which was announced in 1964. Instead of tailoring hardware and software to specific uses, which had generated a proliferation of incompatible systems, the company would offer a single modular system that could be reconfigured as needed with software.

In the beginning, IBM continued to bundle software with the 360, as customers did not themselves have the capabilities to write software for the new machine. But programmers quickly became more familiar with the new system, aided by a blossoming of independent software houses (Fisher, McKie, and Mancke 1983, 322–25). IBM soon commissioned internal studies about the possibility of unbundling—that is, selling software as a distinct package separate from the hardware. At the same time, bundling appeared to violate the spirit of the 1956 consent decree, and the Department of Justice quickly began another investigation of IBM’s practices. In an era in which, as we have seen, courts viewed tying and bundling arrangements as illegal per se, IBM attorneys advised Watson in no uncertain terms that continued software bundling would draw antitrust scrutiny (Watson and Petre 2013, 381). On December 6, 1968, IBM announced its intentions to change its software practices (Steinmueller 1996, 47).

Even though the development of a major industry in packaged software would have to await the advent of the personal computer, some have seen IBM’s decision to unbundle as crucial to the rise of the independent commercial software industry (Mowery 1999). Because the threat of antitrust prosecution clearly played a role in the decision to unbundle, Wu sees this episode as a victory for the “policeman at the elbow.” But a more careful and nuanced look suggests that although the antitrust threat may have moved the process along, unbundling was not only inevitable but also already in the works. Watts S. Humphrey, one of the senior IBM engineers involved in the decision, noted in his memoir that the 1956 consent decree had been the “initial trigger” for unbundling. But in the end, “management had decided that unbundling was needed for competitive reasons as well as to prevent an antitrust suit” (Humphrey 2002, 61).

The problem IBM faced was this: In designing the 360 as a modular system, IBM had created the first major computer platform, “a shared, stable set of hardware, software, and networking technologies on which users build and run computer applications” (Bresnahan 1999, 159). Because the modular design was precisely an attempt to solve the Baumol-disease problem of software design—famously articulated in The Mythical Man-Month (1975) by IBM software architect Fred Brooks—it made little sense to continue to provide all the software for users. In addition, one unintended consequence of IBM’s hardware design decision was the sudden emergence of competitors that offered modules and even major subsystems—so-called plug-compatible products—that worked with the IBM platform and thus could run on IBM software. To the extent that IBM bundled software with hardware, it lacked a mechanism to charge customers for using that software on competitor hardware, even if the company tried somewhat futilely to limit such free riding with contractual restrictions (Humphrey 2002). The real barriers to software unbundling lay in the inadequacy of intellectual property and contractual institutions.[13] The antitrust threat may have impelled the company to solve those problems more rapidly in a crash program, but unbundling would have happened anyway.

The personal computer

If Tom Watson thought that unbundling would preempt antitrust action, he was mistaken. On January 17, 1969, the last business day of the Johnson administration, Attorney General Ramsey Clark affixed his signature to an antitrust complaint against IBM.[14] The suit would drag on for years, consuming tens of millions of dollars in litigation costs, until William Baxter peremptorily dismissed it as “without merit” on January 8, 1982. Robert Bork famously called the suit “the antitrust division’s Vietnam” (New York Times 1981). The suit most certainly affected the way IBM did business. “The antitrust case began to color everything we did,” said Watson, though he cites mostly ridiculous changes in the language executives were allowed to use at meetings (Watson and Petre 2013, 386). (No military metaphors could be used, and high market share had to be described as “market leadership.”) Many have asserted that despite the waste and frequent absurdity of the suit itself, this epochal antitrust event must have weakened IBM and encouraged competitors. Indeed, it has become one of the most widely heard memes of antitrust that this suit was all that prevented IBM from taking over and dominating the next big technology, namely, the personal computer (Wu 2020).

This meme, too, is a myth of antitrust. For one thing, the IBM PC emerged at precisely the time when IBM was savoring victory over the antitrust authorities. More fundamentally, however, this meme misunderstands the history of the personal computer industry. In the end, IBM’s failure in the personal computer market was entirely a result of the company’s own structure, strategy, and capabilities—a result of its own self-perceived strengths, not of any antitrust-induced weaknesses.

The personal computer did not emerge from the labs of IBM or any other large corporations. It developed in an ecosystem of hobbyists taking advantage of the microprocessor, a “computer on a chip” first developed by Intel, itself a fairly recent startup. Because the players in this nascent sector lacked the capabilities to build complete machines, the dominant early versions of the PC adopted a modular structure analogous to that of the IBM 360, albeit on what was initially a much smaller scale (Langlois 1992). This structure permitted low-capability hobbyists and small players to specialize.

Soon, however, IBM decided to enter the PC market. William Lowe, who was in charge of the project, believed that “we can’t do this within the culture of IBM” (Chposky and Leonsis 1988, 9). Significantly, Lowe persuaded management to give him unprecedented autonomy and independence from internal IBM procedures. Philip Donald Estridge, who succeeded Lowe as director of the project, put it this way: “We were allowed to develop like a startup company. IBM acted as a venture capitalist. It gave us management guidance, money, and allowed us to operate on our own” (Business Week 1983). Estridge knew that IBM would have to make heavy use of outside vendors for parts and software. He insisted his designers use a modular bus system, based on the design of existing hobbyist machines, which would allow expandability, and he resisted all suggestions that the IBM team design any of its own add-ons.

The IBM PC was an instant success, exceeding sales forecasts by some 500 percent (Chposky and Leonsis 1988, 24). By 1983, the PC had captured 26 percent of the market. In 1983, IBM earned revenues of $2.7 billion on sales of 670,000 units, besting Apple’s 640,000 units.[15] Thus, in the early 1980s, IBM stepped in to place the imprimatur of the large, vertically integrated corporation on what had been an amateurish, hobbyist-driven industry. Almost immediately, however, a raft of makers of “clone” computers arose, almost all of them startups. By 1988, they had effectively wrested control of the IBM PC away from IBM. By mid-1985, IBM’s market share began plummeting (Baldwin 2019, 20). Already in 1986, more than half of the IBM-compatible computers sold did not have IBM logos on them.

Wu—and many others—would have us believe that the ultimate failure of the personal computer at IBM stemmed importantly from the company’s fear of antitrust prosecution and its weakened condition after the debilitating antitrust suit. In reality, the causes of failure lay elsewhere.

As the PC industry developed, it became clear that rents could be best captured by those who controlled “bottlenecks” in the modular system, notably the standards surrounding the microprocessor (controlled largely by Intel) and the operating system (controlled largely by Microsoft). In the urban legend version of the story, IBM failed to seize those bottlenecks because of a fear of antitrust. But this conclusion is an exercise in reading history backward. At the time the IBM PC was developed, only a handful of computer visionaries ever imagined that this hobbyist technology could possibly expand to become a significant industry, let alone the future of computers. IBM, with its culture of proprietary mainframe technology, was especially disdainful and could not imagine the slightest threat to its core business (Gerstner 2002, 110–20). The company saw no cost in giving Microsoft free rein with the operating system, and it was more concerned with bolstering Intel’s fortunes than in limiting that company’s market power: in late 1982, IBM bought $250 million worth of Intel stock—12 percent of the company—to make sure the chipmaker stayed afloat (Pollack 1982).[16]

One could imagine that even without the ability to control any bottlenecks, IBM might have retained its dominance on the strength of its brand name and logistics capabilities. At the end of the century, another computer firm, Dell, would do just that. But the IBM Corporation was fundamentally ill-designed to manage a technological system over which it did not have proprietary control (Langlois 1997). In April 1987, IBM announced its PS/2 line of computers, featuring a proprietary bus called the Micro Channel Architecture, which was not backward compatible with all older software. Buyers preferred the older standard and stayed away from the new PS/2 machines in droves.[17]

Why did IBM abandon compatibility with the standard it had created? As the PC became more powerful, the other divisions within IBM insisted that the smaller machines be made to fit in with the company’s traditional strategy for information processing. As a result, the MCA bus was designed to facilitate future compatibility with larger computers rather than to serve the needs of the PC customer (Bresnahan, Greenstein, and Henderson 2012, 236). Already in 1983, the PC division had been renamed the Entry Systems Division (ESD) and had lost its direct report to top management. In early 1985, the ESD was pulled completely back within the structure of the company, its autonomy gone. In the end, for what were fundamentally structural reasons, IBM failed to understand the nature of the standard setting in the PC industry, and it attempted to take the PC proprietary without first controlling the standard.

2. Microsoft and the Internet

As Moore’s Law took full hold at the end of the 20th century, smaller computers surpassed the power once offered by minicomputers and then of mainframes, leading to a “competitive crash” in the computer industry as rents were rapidly and spectacularly reallocated (Bresnahan and Greenstein 1999). A world of large, centralized computers, sometimes connected through low-quality connections to remote “dumb” terminals, was being replaced by an economic geography in which users gained access to powerful computers at their own desks. Because it controlled the bottleneck of the dominant PC operating system, Microsoft benefited from this development and came to hold a position in the world of computing that many likened to that of the IBM of old. Yet that landscape, too, was shifting. The development of the internet and the suite of software and protocols that came to be called the World Wide Web was beginning to increase the value of interconnection among computers. By 1996, a startup called Netscape had gained 85 percent of the market for browsers, which accorded users easy access to information scattered around the world (McCullough 2018).

Because software programs—what we now call “apps”—could operate directly in browsers, effectively reducing the significance of the local operating system, Microsoft perceived these new developments as a threat that could realign the PC value chain.[18] The company began a crash program to develop its own browser, to be called Internet Explorer. At the same time, the company used some of the rents from its operating system to threaten or bribe many of its major customers to make Internet Explorer—not Netscape Navigator—their default browser.

The government had begun looking askance at Microsoft as early as 1990 when the Federal Trade Commission and then the Department of Justice started investigating the firm’s contracting practices (Lopatka and Page 1999, 172–76). In 1995, Microsoft signed a consent decree agreeing not to bundle software with the operating system. At Netscape’s urging, the Justice Department began another investigation in 1996, and in May 1998, it filed suit against Microsoft under Sections 1 and 2 of the Sherman Act.[19] Ultimately, the government agreed to a settlement with Microsoft on a set of detailed conduct remedies—but no breakup. The settlement was essentially a regulatory solution: Microsoft’s conduct would be overseen by a three-member panel of computer experts for five years.[20]

Overall, the case took more than three years from filing to settlement, short by the scale of cases like IBM but glacial by the standards of what management writers had begun to call “internet time.” Although Microsoft and all future firms would be warned away from certain kinds of contracting practices—perhaps increasing the incentive to integrate vertically—the case did nothing to change the market in any fundamental way. Microsoft’s Internet Explorer vanquished Netscape Navigator in the “browser war.” And already in 1999, Netscape was acquired by the internet portal America Online (AOL), which retained Internet Explorer as its default browser (Wall Street Journal 1999).[21]

It is another prominent meme of antitrust that the government suit against Microsoft was all that prevented that company from dominating the next big thing – the internet. And, once again, careful historical research suggests otherwise. It is certainly true that, like Tom Watson, Bill Gates of Microsoft saw antitrust as coloring all his firm’s future behavior. In the end, however, Microsoft failed to commandeer the internet for reasons that lay in its own internal structure and strategy—reasons not unlike those that impeded IBM from commandeering the market for the personal computer.

As had been the case at IBM, Microsoft’s success derived from the proprietary closed systems of its core business, the Windows operating system and the Office productivity suite. At one level, a browser could be a complement to these assets. But a full exploitation of the internet, like the one contemplated by Netscape, required an open-source strategy that made the browser a partial substitute for those core assets. In a sense, an aggressive Internet Explorer was as much a threat to the company as Netscape Navigator had been (Bresnahan, Greenstein, and Henderson 2012, 255). Thus, as IBM had done with its PC division, Microsoft turned Internet Explorer over to the managers of legacy divisions to ensure that the software would be managed strictly as a complement to the operating system. Of course, this left the company vulnerable to a competitor that was willing and able to pursue a full-fledged open-source internet strategy, and soon Google Chrome would do to Internet Explorer what Internet Explorer had done to Netscape Navigator.[22]

It is also implausible that Microsoft’s failure in the market for smartphone operating systems can be laid at the feet of antitrust. The company’s efforts in that area were led by the aggressive Steve Ballmer, and they involved the purchase of Nokia, then the world’s largest maker of cell phones—a puzzling move for a supposedly gun-shy business (Wingfield 2015). Although a proprietary operating system for a tiny computer fits well with the company’s core business model, there were, in fact, few benefits to compatibility between smartphones and PC operating systems, and Microsoft was simply outcompeted by nimbler enterprises—Apple and Google—that attained a critical mass of apps more quickly.[23]

Good cop, bad cop

The flip side of the policeman-at-the-elbow argument is that antitrust prosecution or its threat can sometimes have a negative effect. Whereas the beneficial effects of oversight are often negligible, the deleterious ones can be significant.

One of the themes of my recent book (Langlois 2023) is that markets, firms, and complex contracting between firms are all substitutes for one another. If one of those alternatives becomes more costly, players have an incentive to organize using the other alternatives—in some cases, inferior alternatives. In the middle of the 20th century, I argue, the Great Depression, the New Deal, and World War II hampered markets and destroyed market-supporting institutions, which raised the costs of markets and contracting relative to internal organizations within large firms. Thus, in effect, the large vertically integrated firm dominated the middle of the 20th century not because, in some perfect world, it would have been more efficient but because, in the world firms actually inhabited, it was a better alternative than what was available.

Antitrust policy has had a similar effect. The effect was arguably not as large as, say, that of the Great Depression, but it was important at the margins. By making complex contracting between separate firms illegal, antitrust created an incentive to sequester business transactions behind the veil of the corporation. Many historians and legal scholars have articulated versions of this idea in bits and pieces for specific periods. For example, Alfred Chandler (1977) believed that antitrust caused the Great Merger Wave at the turn of the 20th century.[24] Because the Sherman Act made cartels illegal, he argued, businesses quickly sought to form holding companies, which turned visible (and illegal) market transactions into invisible (and, for the time being, legal) internal transactions. A widespread animus against holding companies is a somewhat neglected aspect of the history of antitrust policy—an animus that, perhaps even more than the fear of large size, lay behind the famous antitrust dismemberments of the early century. And when antitrust jurisprudence changed tack and came for the holding company—with the famous breakups of Standard Oil, American Tobacco, and DuPont—businesses responded again. In Chandler’s telling, they adapted by creating integrated managerial enterprises that, because of their complexity and internal interconnectedness, the courts could not easily disassemble.[25]

As economic activity quickened, businesses thrived in the early 20th century, and the large integrated corporation found itself increasingly facing a problem of complexity. The solution was to take advantage of modularity—an elegant principle of design that economizes on information flows (Baldwin 2008; Langlois 2002)—by reorganizing the corporation into semiautonomous divisions in what Chandler christened the multidivisional or M‑form structure (Chandler 1962).[26] By the middle of the 20th century, most of the country’s largest firms had adopted the M‑form. In the severe antitrust regime after World War II, however, some companies began pulling away from a modular structure for much the same reasons as had their early-century predecessors—fear of antitrust breakup.

This motivation was especially clear in the case of General Motors (GM), which was pelted with antitrust suits throughout the century. Especially because GM divisions tracked what had once been separate holding companies—Chevrolet, Buick, Pontiac, Oldsmobile, Cadillac, and so on—top management decided to scramble the organizational structure. Under Frederic Donner in 1965, the company melded more than a dozen body and assembly plants into the General Motors Assembly Division (GMAD). This new structure eliminated duplication by sharing parts across brands, but in addition to requiring information and control to funnel through the corporate office, it also reduced the distinctiveness of GM’s marques and eliminated the diversity of ideas that flowed from semi-independent operations. Although some of the motivation for the new structure was certainly the perception of efficiency, “the creation of the General Motors Assembly Division was also a cunning antitrust strategy” (Cray 1980, 448). The assembly plants of GMAD, including those in Lordstown, Ohio, and Fremont, California, would number among the most dysfunctional loci of labor unrest and dissatisfaction in American automotive history.

There are many other cases of the negative effects of the policeman at the elbow. Jonathan Barnett (2021) argues, for example, that the consent decrees of the post–World War II period, like those with AT&T and IBM, created a weak regime of intellectual property rights that helped replace the robust prewar market in ideas with a system of centralized research and development (R&D) labs—the better to protect intellectual property by hiding innovation. Internal R&D labs also helped point the direction of innovation toward proprietary systemic technology. In 1958, RCA also agreed to a consent decree that created a patent pool into which all comers could dip for free as long as they tossed in some of their own patents (Levy 1981, 159–60). The RCA consent decree was unlike those with AT&T and IBM, often mentioned in the same breath, because it implied licensing at a price of zero rather than at “reasonable” rates. As the patent pool applied only to domestic firms, RCA quickly adopted a strategy of licensing aggressively abroad, where it could still earn royalties. By 1960, Japan accounted for something like 80 percent of the company’s royalty revenues. As many as 82 Japanese electronics firms were licensing RCA patents (Johnstone 1999, 12). A similar compulsory licensing order against Xerox would give Japan access to copier patents as well (Scherer 1992, 187).

In the end, careful history is the antidote to myth. Even when the antitrust policeman at the elbow has been a good cop, not a bad cop, it is far from clear that antitrust has had a significant positive effect on dynamic competition in the United States. And there are plenty of cases in which it has been a bad cop.

Richard N. Langlois

Citation: Richard N. Langlois, Memes and Myths of Antitrust, Network Law Review, Fall 2024.

Footnotes

[1] United States v. Aluminum Co. of America, 148 F.2d 416 (2d Cir. 1945) at 430–431. Hand used these words in the process of denying that Alcoa had achieved its success solely through these means.

[2] This is, of course, a bizarre alteration of precisely the kind of anecdote that economists typically use to persuade students that markets work without constant policing. See, for example, Klein (2012). Economists believe that markets work without constant direction from above not in the abstract, but rather to the extent that there are rules and institutions, notably property rights, that channel rent-seeking behavior in positive-sum directions. Policing is required to make sure drivers—or firms—follow what are clear abstract rules, not to micromanage traffic. (Indeed, some transportation experts believe there are far too many rules for traffic and far too much policing of it [Vanderbilt 2008].)

[3] Whereas Schumpeter had in mind practices like cartels, which he thought were intended to slow the pace of intense dynamic competition, the post-Coasean view of antitrust sees many forms of alleged “anticompetitive” practices as instances of efficient complex contracting, which arise to address endemic problems of uncertainty, asymmetric information, and transaction costs. I return to this point later in the context of tying arrangements.

[4] United States v. Western Elec. Co., Civil Action No. 17-49 (D.N.J.), Jan. 14, 1949.

[5] Attributed to Jack Morton, in “The Improbable Years,” Electronics 41, no. 4 (1968): 81, as quoted by Tilton (1971, 75–76).

[6] United States v. American Tel. and Tel. Co., 552 F. Supp. 131 (D.D.C. 1983).

[7] In the event, however, the agreement sent the deregulated AT&T into a death spiral, as the local operating companies began buying equipment, especially run-of-the-mill equipment, from outside suppliers, destroying the company’s engine of rents. Early in the 21st century, the husk of AT&T would be acquired by SBC Communications, a descendent of one of the “Baby Bells” spun off in the antitrust settlement, which would adopt the name and logo of its quondam parent.

[8] International Business Machines Corp. v. United States, 298 U.S. 131 (1936).

[9] As the Supreme Court declared in 1953, the “essence of illegality in tying agreements is the wielding of monopolistic leverage” (Times-Picayune Pub. Co. v. United States, 345 U.S. 594 (1953)). In reality, tying of this sort is generally about quality control and price discrimination. The question of whether tying arrangements are anticompetitive was in many ways the fulcrum of the Chicago critique of antitrust policy beginning in the 1950s (Bowman 1957; Director and Levi 1956).

[10] United States. v. IBM Corp., Civil Action No. 72-344 (S.D.N.Y), Jan. 25, 1956.

[11] United States. v. United Shoe Machinery Corp., 391 U.S. 244 (1968). For more on United Shoe, see Masten and Snyder (1993).

[12] Although, like other computer companies of the era, IBM benefited from traditional industrial policy—government support of research and development and, much more importantly, government purchase of computers—it is now well understood that IBM’s competitive leadership arose from its nonsubsidized commercial information-processing business (Usselman 1993).

[13] Before the unbundling decision, IBM had pushed what is now called open-source software, since any software others wrote would help sell IBM equipment. After the decision, the company quickly pivoted to a strong proprietary intellectual property rights approach (Usselman 2004, 106).

[14] The complaint is reprinted in Fisher, McGowan, and Greenwood (1983, 353–59).

[15] IDC, cited in Baldwin (2019, 19).

[16] In 1982, Intel was still supplying chips for IBM’s larger computers not just the PC.

[17] In 1988, with some nudges from Intel and Microsoft, nine of the major clone makers banded together to announce the development of a competing 32-bit bus called the Extended Industry Standard Architecture. This, and not the MCA bus, quickly became the standard for the personal computer. By the turn of the millennium, what had once been called the “IBM PC” standard had become the “Wintel” standard.

[18] As did Netscape. Founder Marc Andreessen famously vowed that the browser would reduce Windows to a minor set of “slightly buggy device drivers” (Cusumano and Yoffie 1998, 40).

[19] United States v. Microsoft Corporation, Civil Action No. 98-1232 (D.D.C.), May 18, 1998. For a description of the arguments of the government’s testifying economists, see Bresnahan (2002); for those of Microsoft’s economists, see Evans, Nichols, and Schmalensee (2001). See also Melamed and Rubinfeld (2007).

[20] The court’s stipulation in the case is available at https://www.justice.gov/atr/case-document/stipulation-65.

[21] AOL was interested in Netscape’s server-software business, not in the browser.

[22] Eventually, as Microsoft had feared, the Chrome browser would transform into an operating system, powering inexpensive laptops called Chromebooks, which are used widely in elementary and secondary education and can run Google and other Internet applications without the need for Windows software. In the pandemic year of 2020, some 30 million Chromebooks shipped, roughly 10 percent of the PC market (Armental 2021).

[23] Apple and Google succeeded in smartphones with opposite strategies. Apple bundled its operating system with superior hardware (much like IBM of old), whereas Google made its Android operating system free and open source in order to benefit its search-advertising model. Both of these approaches beat Microsoft’s strategy—linked to its traditional business model—of a proprietary operating system for third-party hardware.

[24] On this, see also Bittlingmayer (1985).

[25] American Tobacco, for example, had become integrated enough that when the court ordered its breakup in 1911, the government had first to create (or re-create) a structure of holding companies (Cox 1933).

[26] The policies of the New Deal effectively put an end to the pyramiding of holding companies, making the United States an outlier in corporate governance around the world (Kandel et al. 2015). The M‑form is in many ways a reinvention of the holding company structure, except that each corporate division in an M‑form is wholly owned and thus has no minority shareholders.

References

- Arnold, Thurman. 1940. Bottlenecks of Business. New York: Reynal and Hitchcock.

- Armental, Maria. 2021. “PC Sales Notch Strongest Growth in a Decade.” Wall Street Journal, January 11.

- Baldwin, Carliss Y. 2008. “Where Do Transactions Come From? Modularity, Transactions, and the Boundaries of Firms,” Industrial and Corporate Change 17 (1): 155–95.

- Baldwin, Carliss Y. 2019. “The IBM PC.” Working Paper 19-074, Harvard Business School, Cambridge, MA, January.

- Barnett, Jonathan M. 2021. “The Great Patent Grab.” In The Battle over Patents: History and Politics of Innovation, edited by Stephen H. Haber and Naomi R. Lamoreaux, 208–77. New York: Oxford University Press.

- Baumol, William J., and William G. Bowen. 1965. “On the Performing Arts: The Anatomy of Their Economic Problems,” American Economic Review 55 (1–2): 495–502.

- Bittlingmayer, George. 1985. “Did Antitrust Policy Cause the Great Merger Wave?” Journal of Law and Economics 28 (1): 77–118.

- Bowman, Ward S. Jr. 1957. “Tying Arrangements and the Leverage Problem,” Yale Law Journal 67 (1): 19–37.

- Bresnahan, Timothy F. 1999. “New Modes of Competition: Implications for the Future Structure of the Computer Industry.” In Competition, Innovation, and the Microsoft Monopoly: Antitrust in the Digital Marketplace, edited by Jeffrey A. Eisenach and Thomas M. Lenard, 155–208. Boston: Kluwer Academic Publishers.

- Bresnahan, Timothy F. 2002. “The Economics of the Microsoft Case.” Working Paper 232, John M. Olin Program in Law and Economics, Stanford University, Stanford, CA.

- Bresnahan, Timothy F., and Shane Greenstein. 1999. “Technological Competition and the Structure of the Computer Industry.” Journal of Industrial Economics 47 (1): 1–40.

- Bresnahan, Timothy F., Shane M. Greenstein, and Rebecca M. Henderson. 2012. “Schumpeterian Competition and Diseconomies of Scope: Illustrations from the Histories of Microsoft and IBM.” In The Rate and Direction of Inventive Activity Revisited, edited by Josh Lerner and Scott Stern, 203–71. Chicago: University of Chicago Press.

- Bresnahan, Timothy F., and Franco Malerba. 1999. “Industrial Dynamics and the Evolution of Firms’ and Nations’ Competitive Capabilities in the World Computer Industry.” In The Sources of Industrial Leadership, edited by David C. Mowery and Richard R. Nelson, 79–132. New York: Cambridge University Press.

- Brooks, Fred. 1975. The Mythical Man-Month. New York: Addison-Wesley.

- Business Week. 1983. “How the PC Project Changed the Way IBM Thinks.” October 3.

- Chandler, Alfred D. Jr. 1962. Strategy and Structure: Chapters in the History of the Industrial Enterprise. Cambridge, MA: MIT Press.

- Chandler, Alfred D. Jr. 1977. The Visible Hand: The Managerial Revolution in American Business. Cambridge, MA: Belknap Press.

- Chposky, James, and Ted Leonsis. 1988. Blue Magic: The People, Power and Politics Behind the IBM Personal Computer. New York: Facts on File.

- Cox, Reavis. 1933. Competition in the American Tobacco Industry, 1911–1932: A Study of the Effects of the Partition of the American Tobacco Company by the United States Supreme Court. New York: Columbia University Press.

- Cray, Ed. 1980. Chrome Colossus: General Motors and Its Times. New York: McGraw-Hill.

- Cusumano, Michael A., and David B. Yoffie. 1998. Competing on Internet Time: Lessons from Netscape and Its Battle with Microsoft. New York: Free Press.

- Director, Aaron, and Edward H. Levi. 1956. “Law and the Future: Trade Regulation.” Northwestern University Law Review 51 (2): 281–96.

- Evans, David S., Albert L. Nichols, and Richard Schmalensee. 2001. “An Analysis of the Government’s Economic Case in U.S. v. Microsoft,” Antitrust Bulletin 46 (2): 163–251.

- Fisher, Franklin M., John J. McGowan, and Joen E. Greenwood. 1983. Folded, Spindled, and Mutilated: Economic Analysis and U.S. v. IBM. Cambridge: MIT Press.

- Forbes India. 2024. “Top 10 Biggest Companies in the World by Market Cap in 2024.” March 19.

- Fisher, Franklin M., James W. McKie, and Richard B. Mancke. 1983. IBM and the U.S. Data Processing Industry. New York: Praeger.

- Gerstner, Louis V. 2002. Who Says Elephants Can’t Dance? Inside IBM’s Historic Turnaround. New York: HarperBusiness.

- Grindley, Peter C., and David J. Teece. 1997. “Managing Intellectual Capital: Licensing and Cross-Licensing in Semiconductors and Electronics.” California Management Review 39 (2): 8–41.

- Humphrey, Watts S. 2002. “Software Unbundling: A Personal Perspective.” IEEE Annals of the History of Computing 24(1): 59–63.

- Johnstone, Bob. 1999. We Were Burning: Japanese Entrepreneurs and the Electronic Revolution. New York: Basic Books.

- Kandel, Eugene, Konstantin Kosenko, Randall Morck, and Yishay Yafeh. 2015. “Business Groups in the United States: A Revised History of Corporate Ownership, Pyramids and Regulation, 1930–1950.” NBER Working Paper 19691, National Bureau of Economic Research, Cambridge, MA.

- Klein, Daniel B. 2012. Knowledge and Coordination: A Liberal Interpretation. New York: Oxford University Press.

- Langlois, Richard N. 1992. “External Economies and Economic Progress: The Case of the Microcomputer Industry.” Business History Review 66 (1): 1–50.

- Langlois, Richard N. 1997. “Cognition and Capabilities: Opportunities Seized and Missed in the History of the Computer Industry.” In Technological Innovation: Oversights and Foresights, edited by Raghu Garud, Praveen Nayyar, and Zur Shapira, 71–94. New York: Cambridge University Press.

- Langlois, Richard N. 2002. “Modularity in Technology and Organization,” Journal of Economic Behavior and Organization 49 (1): 19–37.

- Langlois, Richard N. 2023. The Corporation and the Twentieth Century: The History of American Business Enterprise. Princeton, NJ: Princeton University Press.

- Levy, Jonathan D. 1981. Diffusion of Technology and Patterns of International Trade: The Case of Television Receivers. PhD Diss., Yale University.

- Lewis, Anthony. 1956. “AT&T Settles Antitrust Case; Shares Patents,” New York Times, January 25.

- Lopatka, John E., and William H. Page. 1999. “Antitrust on Internet Time: Microsoft and the Law and Economics of Exclusion.” Supreme Court Economic Review 7: 157–231.

- Masten, Scott E., and Edward A. Snyder. 1993. “United States versus United Shoe Machinery Corporation: On the Merits.” Journal of Law and Economics 36 (1): 33–70.

- McCullough, Brian. 2018. How the Internet Happened: From Netscape to the iPhone. New York: Liveright.

- Melamed, A. Douglas, and Daniel L. Rubinfeld. 2007. “U.S. v. Microsoft: Lessons Learned and Issues Raised,” In Antitrust Stories, edited by Eleanor M. Fox and Daniel A. Crane, 287–311. New York: Foundation Press.

- Mowery, David C. 1999. “The Computer Software Industry.” In The Sources of Industrial Leadership, edited by David C. Mowery and Richard R. Nelson, 133–68. New York: Cambridge University Press.

- Nagler, Markus, Monika Schnitzer, and Martin Watzinger. 2021. “Patents on General Purpose Technologies: Evidence from the Diffusion of the Transistor.” CEPR Discussion Paper 15713, Centre for Economic Policy Research.

- New York Times. 1981. “U.S. vs. I.B.M.” February 15.

- Peters, Geoffrey M. 1985. “Is the Third Time the Charm? Comparison of the Government’s Major Antitrust Settlements with AT&T This Century,” Seton Hall Law Review 15: 252–75.

- Pollack, Andrew. 1982. “In Unusual Step, I.B.M. Buys Stake in Big Supplier of Parts.” New York Times, December 23.

- Scherer, Frederic M. 1992. International High-Technology Competition. Cambridge, MA: Harvard University Press.

- Schumpeter, Joseph A. 1950. Capitalism, Socialism, and Democracy. New York: Harper and Brothers.

- Sobel, Robert. 1983. IBM: Colossus in Transition. New York: Bantam Books.

- Steinmueller, W. Edward. 1996. “The U.S. Software Industry: An Analysis and Interpretative History.” In The International Computer Software Industry, edited by David C. Mowery, 15–52. New York: Oxford University Press.

- Temin, Peter, and Louis Galambos. 1987. The Fall of the Bell System: A Study of Prices and Politics. New York: Cambridge University Press.

- Tilton, John E. 1971. International Diffusion of Technology: The Case of Semiconductors. Washington, DC: Brookings Institution.

- Usselman, Steven W. 1993. “IBM and Its Imitators: Organizational Capabilities and the Emergence of the International Computer Industry.” Business and Economic History 22 (2): 1–35.

- Usselman, Steven W. 2004. “Public Policies, Private Platforms: Antitrust and American Computing.” In Information Technology Policy: An International History, edited by Richard Coopey, 97–120. Oxford: Oxford University Press.

- Usselman, Steven W. 2009. “Unbundling IBM: Antitrust and the Incentives to Innovation in American Computing.” In The Challenge of Remaining Innovative: Insights from Twentieth-Century American Business, edited by Sally H. Clarke, Naomi R. Lamoreaux, and Steven W. Usselman, 249–79. Stanford, CA: Stanford University Press.

- Vanderbilt, Tom. 2008. “The Traffic Guru.” Wilson Quarterly 32 (3): 26–32.

- Wall Street Journal. 1999. “AOL Says Deal to Acquire Netscape Has Been Completed.” March 18.

- Watson, Thomas J. Jr., and Peter Petre. 2013. Father, Son & Co.: My Life at IBM and Beyond. New York: Random House.

- Wingfield, Nick. 2015. “A $7 Billion Charge at Microsoft Leads to Its Largest Loss Ever.” New York Times, July 21.

- Wu, Tim. 2020. “Tech Dominance and the Policeman at the Elbow.” In After the Digital Tornado: Networks, Algorithms, Humanity, edited by Kevin Werbach, 81–100. Cambridge, MA: Cambridge University Press.

- Wu, Tim. 2023. “The Google Trial Is Going to Rewrite Our Future,” New York Times, September 18.